ID card is a major supporter for e-services offered by financial institutions

AL Falasi: the memorandum strengthening the bank’s efforts to support e-transformation services

Dr. Al Ghafli: the memorandum is a foundation stone for the expansion of the use of the ID card as a fundamental enabler to the services of banking sector

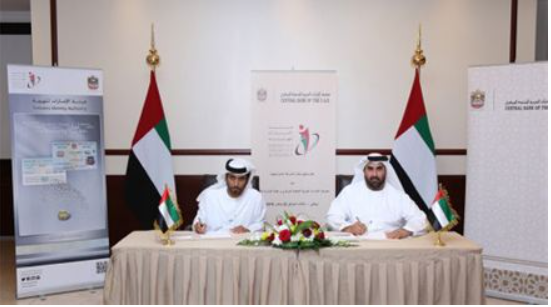

Central Bank of the UAE announced that it has signed a Memorandum of strategic partnership with the Emirates Identity Authority (EIDA) on building an effective partnership between the two sides to achieve their common strategic objectives, which include the adoption of digital identity in electronic services provided by banking institutions in the UAE, and the sharing of knowledge, expertise and institutional experiences, as well as the exchange of views and advice towards supporting modernization and institutional development.

The Memorandum of strategic partnership was signed by H.E. Muhammad Ali Bin Zayed Al Falasi, Central Bank’s Deputy Governor, and H.E. Dr. Saeed Abdullah bin Motlaq Al Ghafli, Director General of the Emirates Identity Authority, in presence of a number of senior officials from both parties.

This Memorandum of strategic partnership aims in overall to promote communication and cooperation between the two sides in order to achieve common objectives that serve the interests of the UAE, and to develop, improve and simplify the procedures for authenticating and validating customers’ identity by relying only on the Id card issued by EIDA, as a major source of identification in the field of financial services provided by banking institutions in the UAE, with the objective of enhancing and diversifying these services; hence contributing to the improvement of the state’s ranking in this area.

On this occasion, H.E Muhammad Ali Bin Zayed Al Falasi, the Deputy Governor of the Central Bank stated that “by signing this Memorandum, the Central Bank contributes in strengthening the electronic transformation of the services provided by financial institutions in line with the vision of the UAE’s leadership with respect to Smart Government”. He also expressed his pleasure in signing this Memorandum with the Emirates Identity Authority noting that “this step is of great importance in supporting the emergence of more sophisticated electronic financial services in the UAE that meet the needs of all the stakeholders in terms of easiness, efficiency and safety, thanks to the digital identity system, which has proved its efficiency since its launch by EIDA in 2009”.

For his part, H.E. Dr. Saeed Abdullah bin Motlaq Al Ghafli, Director General of the Emirates Identity Authority stressed that this Memorandum constitutes the foundation for an extensive use of the “smart” identity card and its adoption as the essential enabler for more services in the financial and banking sector, as well as for the expansion in adding new services to this card, making it the first card in the UAE in terms of services provided, and beyond just being a card to authenticate identity only.

He also added that the UAE recorded an international scoop by the use of the ID card in the field of financial and banking transactions and banking systems, through its adoption as an ATM card by a number of banks operating in the country.

In this regard, Dr. Al Ghafli pointed out that the signing of this Memorandum will encourage various financial institutions to benefit from the functionalities of this card, which would help in increasing the advantages for customers and reducing the costs related to both data processing and card issuance; hence contributing in the promotion of economic efficiency and competitiveness of the UAE.

Moreover, Dr. Ghafli confirmed the EIDA’s readiness to provide full support to institutions wishing to take advantage of the potential of the ID card in terms of technical functionalities for the development of services provided to their customers, and reduce the time and effort required for the implementation of these services, as well as the EIDA’s willingness to cooperate with them to develop new services, which ensure added value for customers, and quality, efficiency and effectiveness in the performance of these institutions.

Latest Posts

ICP Discusses the “Single Point” Passenger Project with a Bahraini Delegation

ICP Participates in the World Governments Summit 2026 with a High-Level Delegation

The Director General of ICP Discusses the Development of Digital Services with Senior Officials

ICP Exchanges Governance Best Practices with the National Center of Meteorology

Zayed International Airport celebrated the UAE–Kuwait Brotherhood Week

German

German Portuguese

Portuguese French

French Russian

Russian Chinese

Chinese

Rate your experience